CROWN MANSION

The Crown Mansion in New York, a premier real estate development situated in the vibrant neighborhood of Flushing, is set to be a mixed-use complex encompassing luxury apartments and commercial spaces, spanning nearly 140,000 square feet.

Strategically located at the heart of Flushing, the project is spearheaded by Shanghai Construction Group America, boasting two decades of development experience in the United States, and is anticipated to emerge as a new landmark upon its completion.

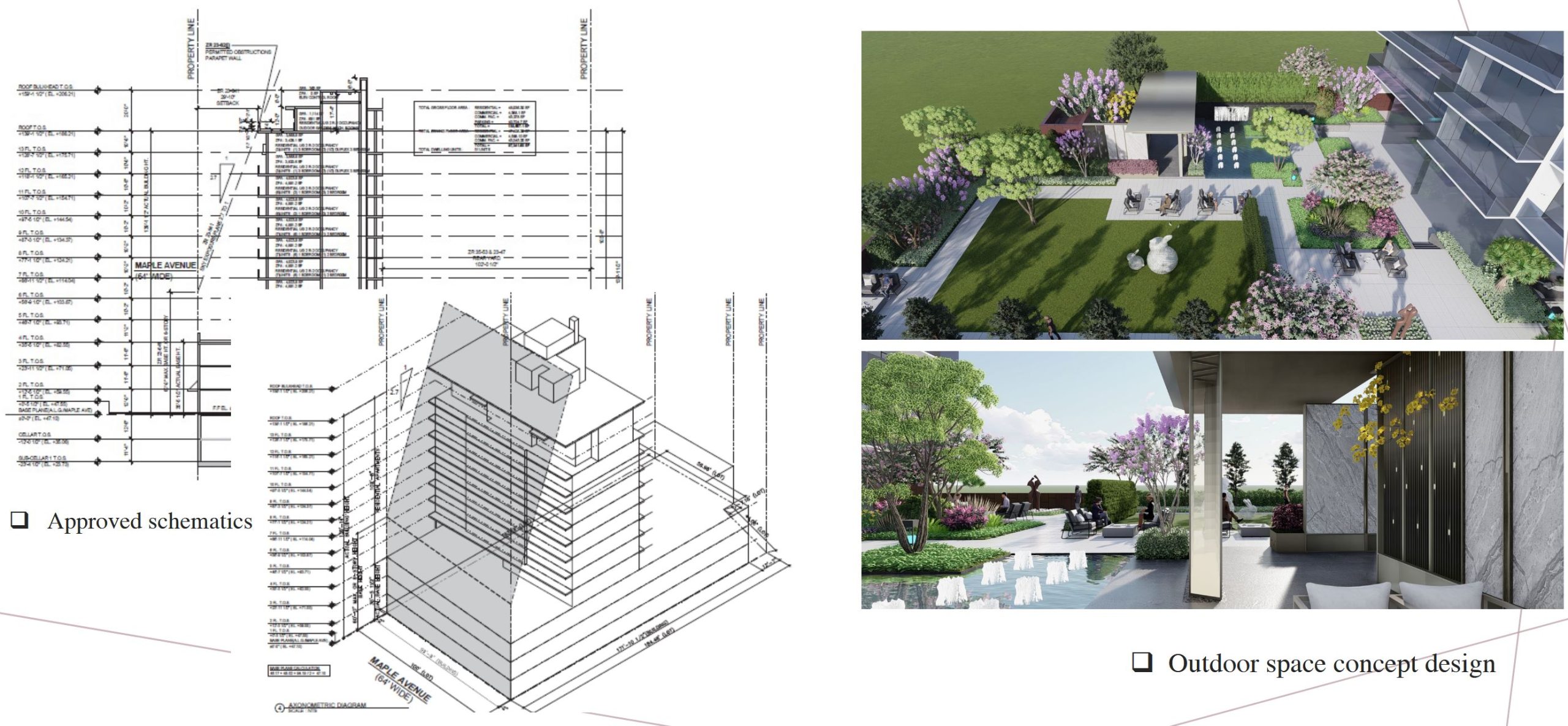

Most of the preliminary design and development work has been concluded, with construction expected to commence in August 2024 and the project slated for exit by 2027.

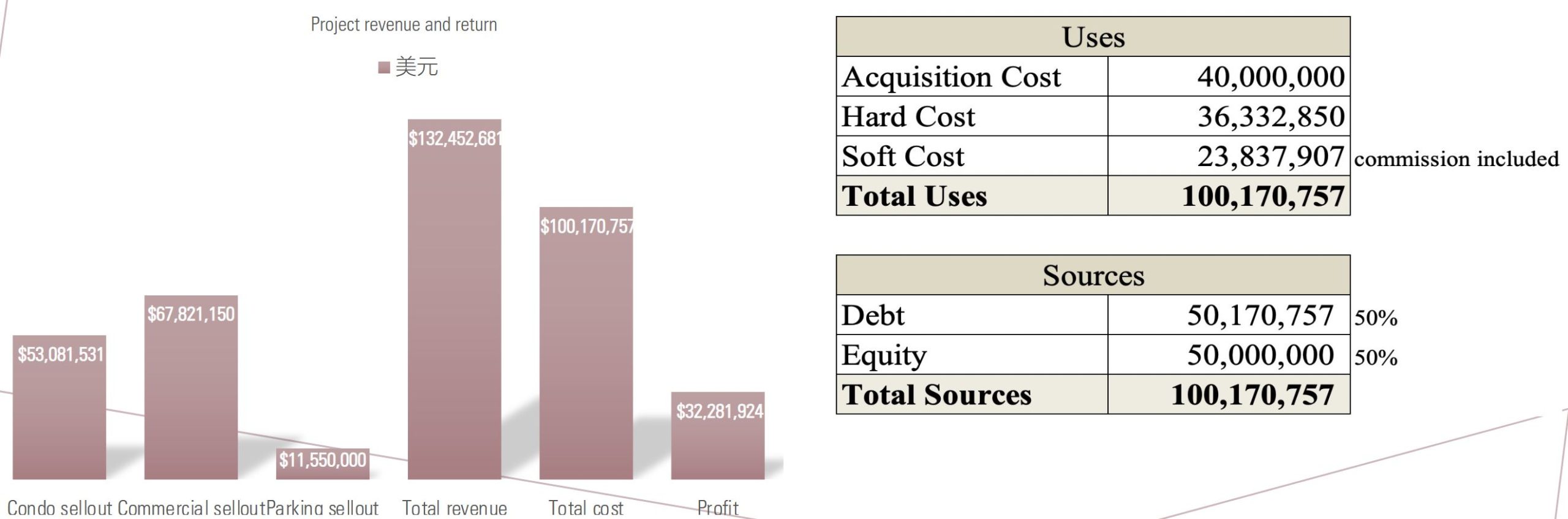

The total investment for the project stands at $100 million, with projected sales revenue of $132 million and an anticipated profit of $32 million. The financing plan includes a debt investment of $50 million alongside an equity investment of $50 million.

Currently, an equity investment opportunity is being offered to Limited Partners (LPs), with a total LP investment of $35 million, expected to yield a net income for LPs of $19.12 million. This represents an investment return rate of 55% and an annualized return rate of 18%.

LOCATING IN FLUSHING- NEW YORK'S MOST DYNAMIC AND RAPIDLY EMERGING AREA.

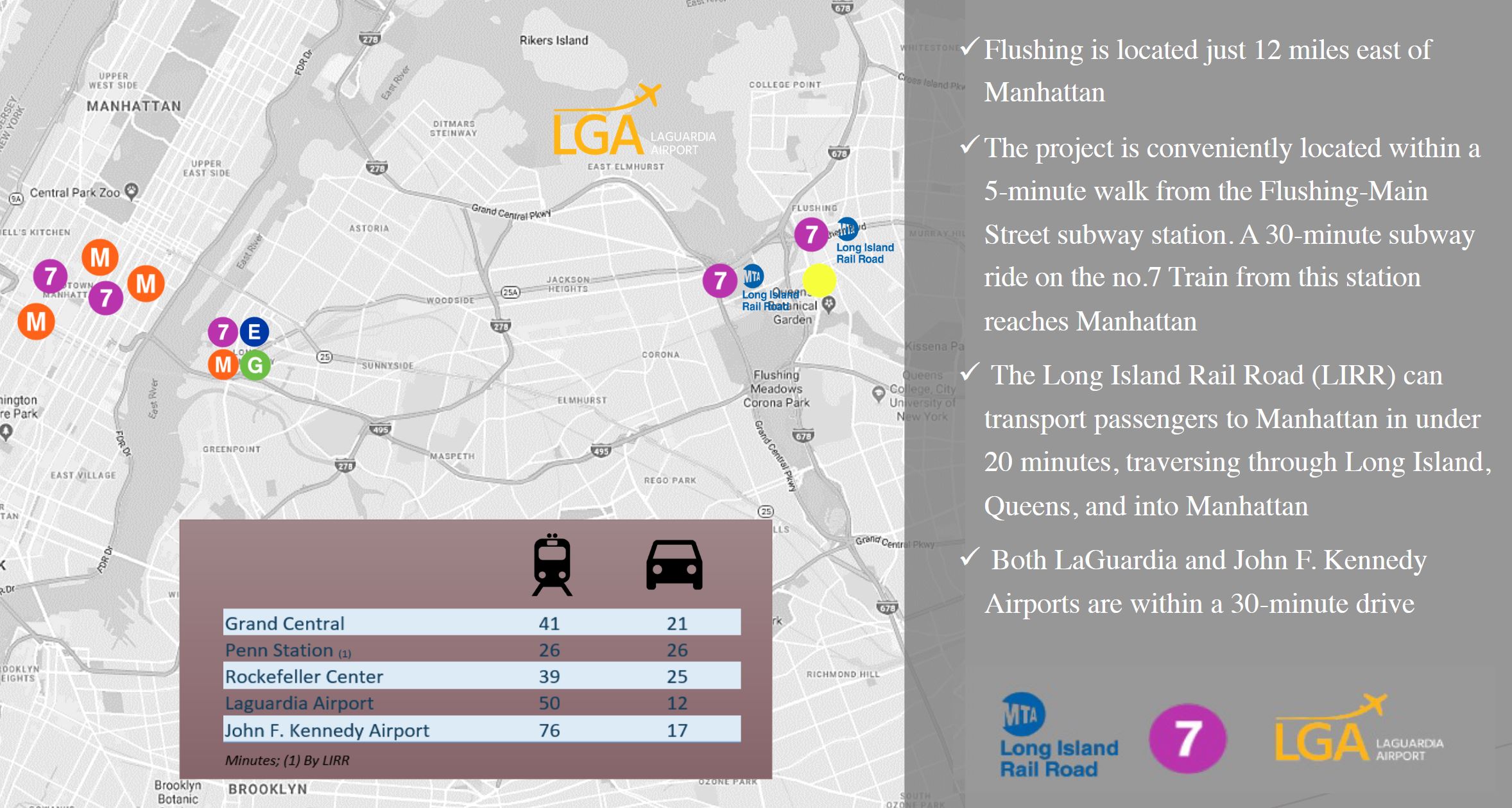

The building is sited at 134-53 Maple Avenue, Flushing, Queens 11355, occupying a prime location in the heart of Flushing’s most bustling area—near the Main Street subway station, and covers approximately 19,168 ft2.

Flushing is renowned as one of New York’s most vibrant peripheral communities, having experienced rapid and continuous development over the past several decades, representing a quintessential blend of traditional and modern urban community ideals.

- Convenient location and transportation access

- The most dynamic commercial hub

- Extremely active real estate market

CONVENIENT LOCATION AND TRANSPORTATION ACCESS

THE MOST DYNAMIC COMMERCIAL HUB

- Flushing is located in the fourth largest central business district of New York City.

- The Tangram Shopping Center, covering 275,000 ft2, has become a gathering place for the Asian and Western restaurants and fashion brands, marking it as a vanguard of style in Flushing.

- The Skyview Center Shopping Mall spans 800,000 ft2.

- The Queens Center Shopping Mall is one of the largest indoor shopping centers in the Northeast, featuring over 108 retail stores, the banquet facilities capable of accommodating 1,500 people, and an Asian cuisine food court.

- Bordering Flushing Meadows Corona Park, the fourth largest in New York at 897 acres and site of two World’s Fairs.

- The park is also home to Citi Field, the home stadium of the New York Mets baseball team.

- The Queens Botanical Garden covers 39 acres with extensive gardens, art exhibits, and event spaces.

CROWN MANSION WILL BECOME THE NEW BENCHMARK BUILDING IN FLUSHING

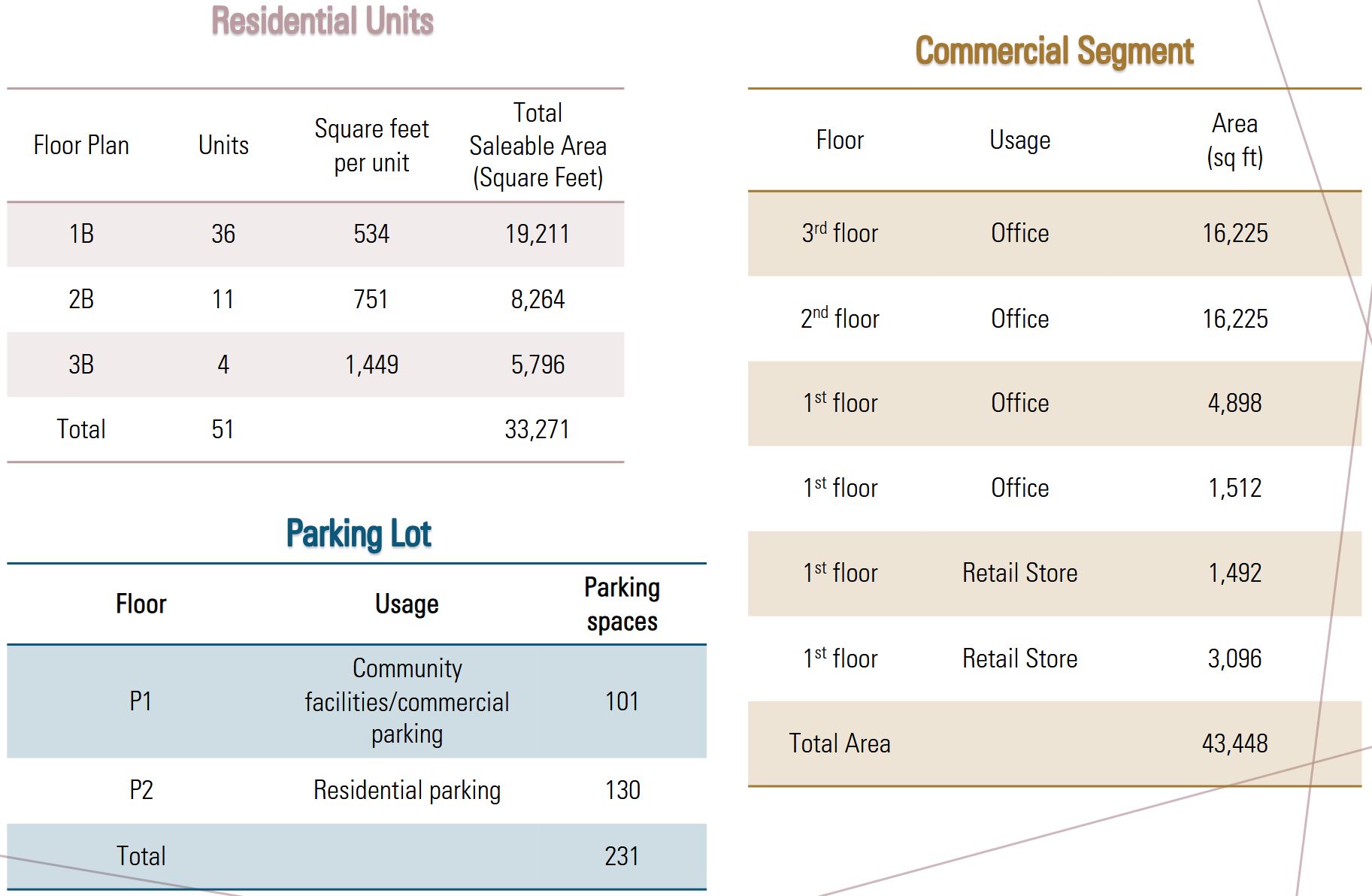

- The total construction spans 139,607 square GSF, including 98,902 square feet at the ground level. The building features 51 luxury condominiums across floors 4 to 13, and over 40,000 square feet dedicated to office and retail spaces on the first three floors.

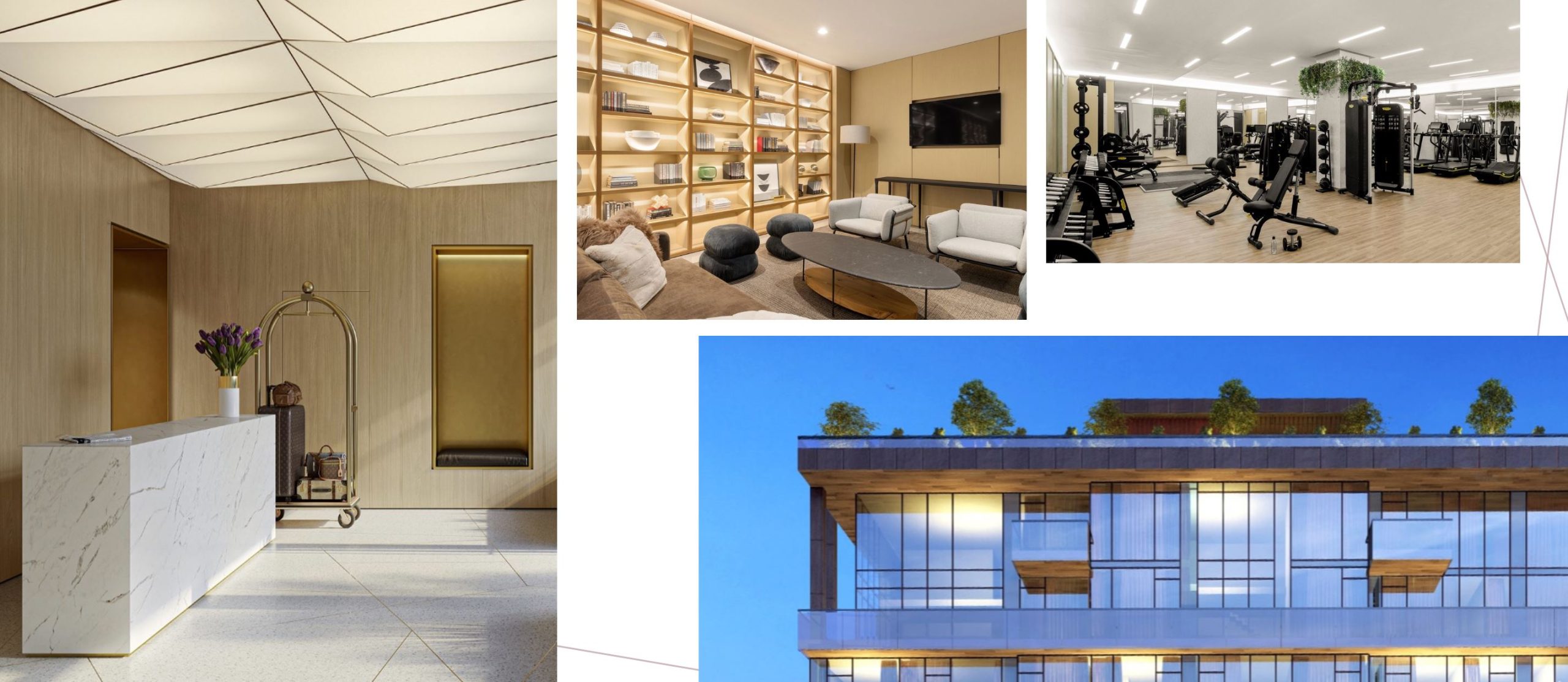

- The building’s residences are crafted with premium luxury finishes, poised to become Flushing’s new standard of quality. Addressing market trends and buyer preferences, the design emphasizes efficient and adaptable layouts, focusing on the highly sought-after one and two-bedroom units to facilitate swift market absorption.

- The building’s commercial offices will be sold as much-needed medical clinics in Flushing, with the ground-floor retail designated for flagship brand dining establishments.

CROWN MANSION WILL BE THE NEW BENCHMARK BUILDING

CROWN MANSION WILL BE THE NEW BENCHMARK BUILDING

EXPERIENCED DEVELOPMENT TEAM

SCG America (SCGA), a wholly-owned subsidiary of Shanghai Construction Group with its headquarters in New York City, has more than two decades of development experience in the U.S. The company’s operations encompass general contracting, construction management, real estate development, and real estate fund management. SCGA has contributed to over $3 billion in real estate investments and developments across the U.S., including the notable Tangram project in Flushing, which comprises 320 luxury apartments, hotel space, office buildings, and retail complexes, establishing it as a landmark.

Shanghai Construction Group, the parent company, is under the Shanghai Municipal State-owned Assets Supervision and Administration Commission and went public on the Shanghai Stock Exchange in 1998. As a leading figure in China’s construction sector, it was ranked 351st on the Fortune Global 500 in 2022 and 8th among the ENR’s top 250 global contractors, with its annual production of pre-mixed concrete exceeding 45 million cubic meters, ranking third in China and fifth worldwide.

American Chengyi Investment Management Group (ACIM), established in the United States in 2012, focuses on real estate development and investment across the country. Led by Chairwoman Elizabeth Chen, a well-respected leader in the business community, Ms. Chen has extensive management experience in sectors such as real estate, manufacturing, finance, and healthcare. Since immigrating to the United States, she has successfully undertaken numerous real estate investments in the New York metropolitan area, emerging as a prominent Chinese- American business leader. In addition to her business achievements, Ms. Chen is passionately involved in philanthropy, serving as the chairperson of the International Education Charitable Foundation.

Founded by Anthony Moralie, Morali Architects has over 40 years of architectural experience in New York City. The firm is renowned for its significant contributions to some of the city’s most iconic buildings and sites, including the Rainbow Room at Rockefeller Center, Ciprianis, and Bowery Bank.

PROJECT INVESTMENT AND RETURNS ANALYSIS

- The total cost for the project is estimated at $100 million, offering a moderate scale conducive to swift construction and disposition phases, thus ensuring controlled risk exposure.

- Projected gross revenues are anticipated to reach $132 million, underpinned by strategic allocation to highly sought-after one and two bedroom luxury units and undersupplied medical clinics, facilitating accelerated absorption rates.

- With an expected profit margin of $32 million, the project presents an equity return rate ofc approximately 65%. This investment proposition is characterized by a high safety coefficient and lucrative profit potential, aligning with discerning investor criteria for robust returns.

FINANCING PLAN

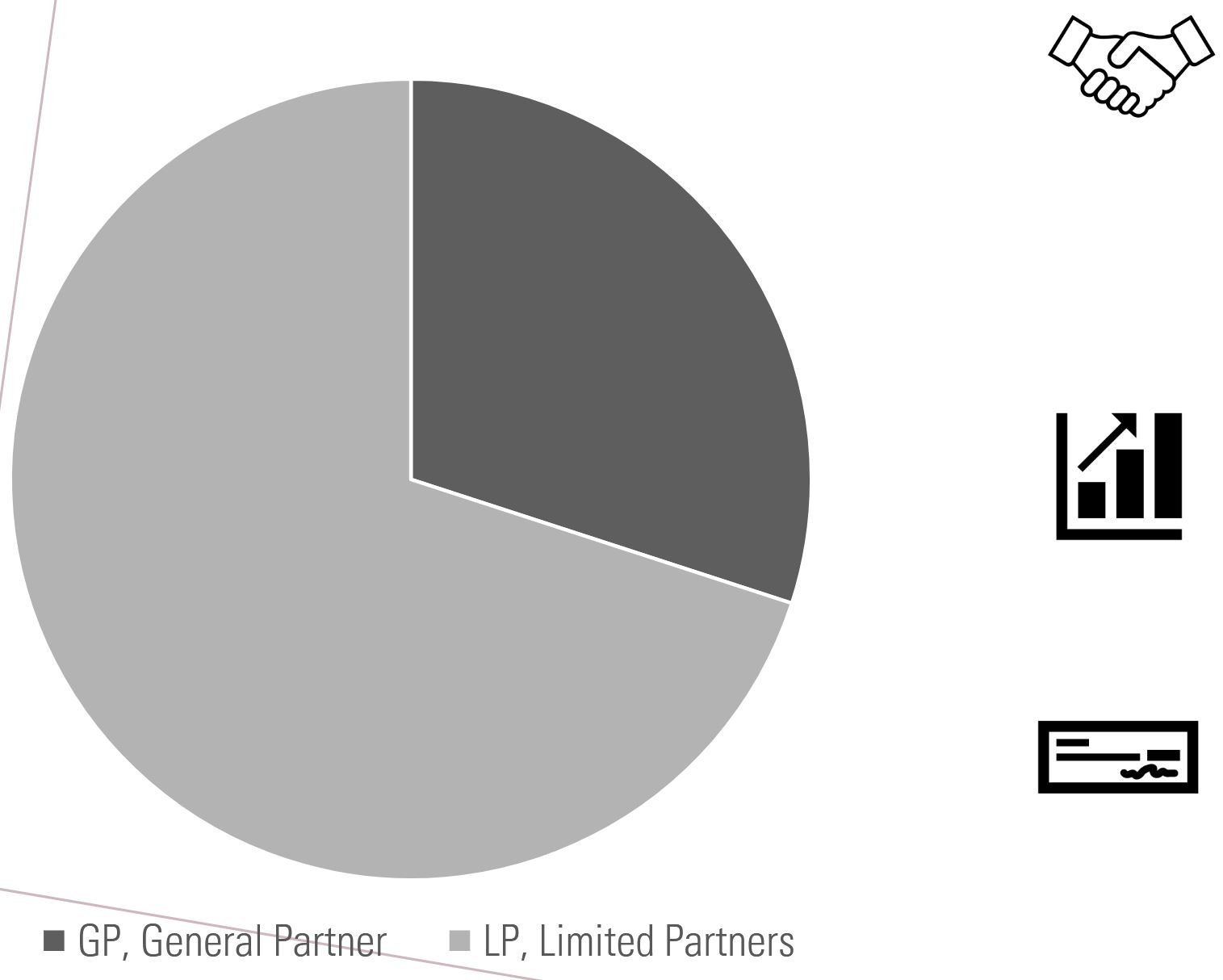

Capital Contribution Scheme:

General Partner (GP) has invested 30% of the total equity, equating to $15 million, and will assume the lead role in project development and operational oversight. The investment from equity funds, represented by Limited Partners (LPs), will constitute the remaining 70% of the funding, amounting to $35 million, aligning with the strategic financial planning and execution of the project.

Expected Returns for Limited Partners (LPs):

Limited Partner investors can anticipate a relatively stable return over a 3-year investment horizon. The expected return on equity for LPs is projected at 55%, with an annualized net return rate of 18%, after accounting for General Partner (GP) management fees and carried interest deductions.

General Partner (GP) Allocation Scheme:

The GP will oversee the management of the project and receive a management fee of 1%. Furthermore, after ensuring a 10% annual return for the Limited Partners (LPs), the GP will extract 20% from the additional profits as a promote.